BIBD enables cardholders to pay securely on mobile devices with

Rambus Token Service Provider solution

SUNNYVALE, Calif. & BANDAR SERI BEGAWAN, Brunei Darussalam--(BUSINESS WIRE)--

Rambus

Inc. (NASDAQ: RMBS) a leader in digital security, semiconductor and

IP products and services, today announced that Bank

Islam Brunei Darussalam (BIBD), the largest bank in Brunei, has

selected the Rambus

Token Service Provider (TSP) as part of its mobile payment strategy

to enable secure transactions to its customers.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20181205005205/en/

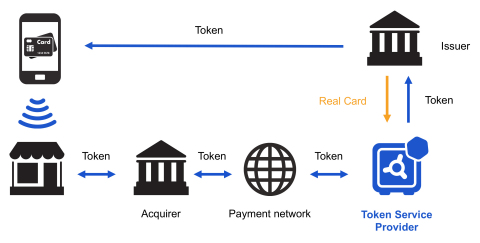

Rambus Token Service Provider (Graphic: Business Wire)

As Asia has seen a proliferation of digital payment solutions in recent

years, the need to secure digital transactions has become critical to a

bank’s success. With the rise of solutions such as QR-based payment, NFC

(near field communication), host card emulation (HCE) and real-time

payments, consumer trust has become critical to success, with security

and fraud prevention more important than ever to businesses and

end-users alike.

Payment tokens help minimize fraud

The Rambus TSP solution helps secure the BIBD NEXGEN Mobile banking app,

allowing customers to digitize their cards and send payments, without

revealing any sensitive payment information. The Rambus software

platform will replace cardholders’ details with unique reference numbers

to minimize the risk of fraud and the severity of data breaches. Unique

payment tokens are worthless if stolen.

Tokenization and host card emulation support secure payments within

BIBD NEXTGEN Mobile app

By generating temporary personal account numbers (PANs), or payment

tokens, the Rambus solution is a modular platform that combines

tokenization with host card emulation to enable payment issuers and

processors to securely perform a wide variety of roles in the payment

process. Using HCE and tokenization, BIBD will enable their cardholders

to securely pay using their mobile app.

“We’re delighted to be selected by the largest bank in Brunei to secure

mobile payments for BIBD’s customers,” said Chakib Bouda, vice president

and CTO, Rambus Payments. “This collaboration reinforces our leadership

in mobile payment and tokenization technologies. It also marks

significant progress in our efforts to expand into the Asian marketplace

that is seeing a boom in digital payment solutions.”

“As the security of our customers is our highest priority, we are

pleased to announce our collaboration with Rambus to enable our

customers to pay safely and securely with their mobile devices,” said

Dr. Gyorgy Ladics, COO, BIBD. “While digital payment methods grow

exponentially in the marketplace, customers are becoming increasingly

mobile-centric; therefore, it’s imperative to facilitate mobile

transactions in a hassle-free and secure manner, providing the ultimate

ease of mind for our customers.”

For more information on Rambus mobile payment solutions, visit rambus.com/payments.

Or, to learn more about the Rambus Token Service Provider solution, go

to rambus.com/security/payments/token-service-provider/.

Follow Rambus:

Company website: rambus.com

Rambus

blog: rambus.com/blog

Twitter: @rambusinc

LinkedIn: www.linkedin.com/company/rambus

Facebook: www.facebook.com/RambusInc

About Rambus Security

Rambus Security is dedicated to providing a secure foundation for a

connected world. Our innovative solutions span areas including tamper

resistance, network security, mobile payment, smart ticketing

and trusted transaction services. Rambus foundational technologies

protect nearly nine billion licensed products annually, providing secure

access to data and creating an economy of digital trust between our

customers and their customer base. Additional information is

available at rambus.com/security.

About Rambus

Dedicated to making data faster and safer, Rambus creates innovative

hardware, software and services that drive technology advancements from

the data center to the mobile edge. Our architecture licenses, IP cores,

chips, software, and services span memory and interfaces, security, and

emerging technologies to positively impact the modern world. We

collaborate with the industry, partnering with leading chip and system

designers, foundries, and service providers. Integrated into tens of

billions of devices and systems, our products and technologies power and

secure diverse applications, including Big Data, Internet of Things

(IoT) security, mobile payments, and smart ticketing. For more

information, visit rambus.com.

About BIBD

BIBD is the largest financial institution in Brunei Darussalam, leading

the market in terms of assets, financings, and deposits, with a vision

to become globally recognised as the benchmark Islamic Finance

Institution.

BIBD is headquartered in Bandar Seri Begawan with the largest network of

17 branches and 67 ATMs located strategically in all four districts of

Brunei Darussalam.

BIBD was ranked 38th in terms of Soundness (Capital Asset Ratio) in the

top 1,000 World Banks by “The Banker” in 2016. BIBD is one of the safest

banks in the world and is given an impressive credit rating of A- by

Standard & Poor’s in 2015, the highest for a Bruneian bank and among the

highest in the region, which was reaffirmed in 2017. BIBD has been named

the “Best Retail Bank in Brunei” by The Asian Banker six years in a row

from 2013 to 2018.

For more information on any of BIBD’s other products or services, please

log on to the BIBD website at http://www.bibd.com.bn,

visit your nearest BIBD branch or get in touch with the BIBD Contact

Centre at 2238181.

Source: Rambus Inc.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20181205005205/en/

CORI PASINETTI

Rambus Corporate Communications

Tel: (408)

462-8306

e-mail: cpasinetti@rambus.com

SHAIRAZI ZAINUDDIN

BIBD Corporate Communications

Tel: +673

2269 817

Fax: +673 2222 430

e-mail: shairazi.zainuddin@bibd.com.bn

Source: Rambus Inc.